Cosmetics special report: The rise of domestic products, optimistic about the development of local cosmetics

1. Chinese cosmetics industry is on the rise

1.1 The cosmetics industry as a whole maintains an increasing trend

Cosmetics definition and classification. According to the Regulations on the Supervision and Administration of Cosmetics (2021 edition), cosmetics refer to daily chemical industrial products that are applied to skin, hair, nails, lips and other human body surfaces by rubbing, spraying or other similar means for the purpose of cleaning, protecting, beautifying and modifying. Cosmetics can be divided into special cosmetics and ordinary cosmetics, among which special cosmetics refer to those used for hair color, perm, freckle and whitening, sunscreen, hair loss prevention and cosmetics that claim new effects. The scale of the global cosmetics market shows an overall growth trend. According to China Economic Research Institute, from 2015 to 2021, the global cosmetics market grew from 198 billion euros to 237.5 billion euros, with a CAGR of 3.08% during the period, maintaining an overall growth trend. Among them, the global cosmetics market size declined in 2020, mainly due to the impact of COVID-19 and other factors, and the market size rebounded in 2021.

North Asia has the largest share of the global cosmetics market. China by the industry, according to data from the institute in 2021, north Asia, North America, Europe region in the global cosmetics market accounted for 35%, 26% and 22% respectively, which has more than a third of the north Asia accounted. It is obvious that the global cosmetics market is mainly concentrated in economically developed regions, with North Asia, North America and Europe taking up more than 80% of the total.

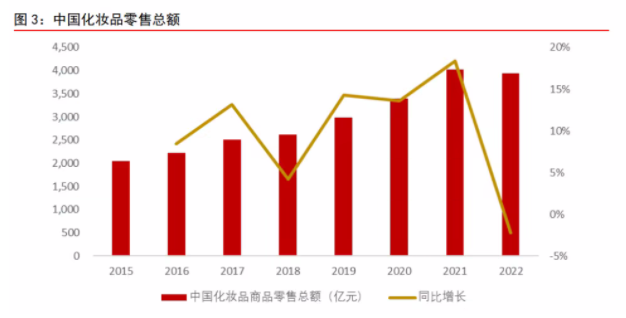

The total retail sales of cosmetics commodities in China have maintained relatively rapid growth and will still have high growth attributes in the future. According to the National Bureau of Statistics, from 2015 to 2021, the total retail sales of cosmetics products in China increased from 204.94 billion yuan to 402.6 billion yuan, with a CAGR of 11.91% during the period, which is more than three times the average annual compound growth rate of the global cosmetics market in the same period. With the development of social economy, the demand for cosmetics is becoming more and more common and the sales channel of cosmetics is becoming more and more diversified. The whole scale of cosmetics market has been growing rapidly in recent years. In 2022, with the repeated COVID-19 epidemic and large-scale lockdown in some areas, domestic logistics and offline operations were affected, and the retail sales of cosmetics in China declined slightly, with the total annual retail sales of cosmetics reaching 393.6 billion yuan. In the future, with the post-epidemic recovery and the rise of Guochao cosmetics, the domestic cosmetics industry will continue to develop with high quality, and the scale of Chinese cosmetics is expected to maintain high growth.

Skin care products, hair care products and makeup are three important segments of the cosmetics market, among which skin care products account for the first place. Data from China Economic Research Institute shows that in the global cosmetics market in 2021, skin care products, hair care products and makeup will account for 41%, 22% and 16% respectively. According to Frost & Sullivan, skin care products, hair care products and makeup will account for 51.2 percent, 11.9 percent and 11.6 percent, respectively, of the Chinese cosmetics market in 2021. Overall, in the domestic and foreign cosmetics market, skin care products occupy the main position, in the domestic market share is more than half. The difference is that domestic hair care products and makeup account for a similar proportion, while in the global makeup market, hair care products account for nearly 6 percentage points more than the comparison makeup.

1.2 Skin care scale of our country whole keeps growing momentum

The scale of Chinese skin care market keeps growing and is expected to exceed 280 billion yuan in 2023. According to iMedia Research, from 2015 to 2021, the size of China’s skincare market rose from 160.6 billion yuan to 230.8 billion yuan, with a CAGR of 6.23 percent during the period. In 2020, due to the impact of COVID-19 and other factors, the scale of Chinese skin care market decreased, and in 2021, the demand was gradually released and the scale returned to growth. Imedia Research predicts that from 2021 to 2023, China’s skincare market will grow at an average annual compound growth rate of 10.22%, and will grow to 280.4 billion yuan in 2023.

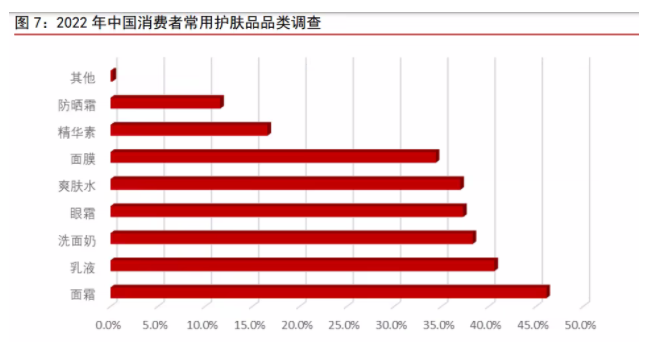

In our country, skin care products are various and disperse, face cream, emulsion are commonly used products. According to iMedia Research, in 2022, Chinese consumers used skin care products with the highest use rate of cream and lotion, with 46.1% of consumers using cream and 40.6% using lotion. Secondly, facial cleanser, eye cream, toner and mask are also the most used products by consumers, accounting for more than 30%. With the improvement of people’s living standards, they have higher requirements for appearance, increased demand for skin care such as maintenance and anti-aging, and more refined requirements for skin care products, which promotes the skin care industry to continue innovative development in different segments, and more diversified and functional products.

1.3 The growth rate of Chinese makeup scale is relatively bright

China’s makeup market maintains rapid growth and is more impressive than the skin care industry. According to iMedia Research, from 2015 to 2021, China’s makeup market grew from 25.20 billion yuan to 44.91 billion yuan, with a CAGR of 10.11%, much higher than the growth rate of skincare market in the same period. Similar to skin care products, China’s makeup market was affected by the epidemic in 2020, and the scale of the whole year declined by 9.7%. Because the epidemic had a greater impact on the demand for makeup, while the demand for skin care was relatively stable, the size of the makeup market declined more than that of the skin care market in that year. From 2021, the epidemic prevention and control gradually became normal, and in 2023, China implemented Class B and B tube for the novel coronavirus. The impact of the epidemic gradually subsided, and residents’ demand for makeup improved. Imedia Research predicts that China’s makeup market will reach 58.46 billion yuan in 2023, with a compound growth rate of 14.09% from 2021 to 2023.

The utilization rate of face, neck product and lip product is very high in our country. According to iMedia Research, face and neck products, including foundation, BB cream, loose powder, powder and contorting powder, are the most commonly used makeup products by Chinese consumers in 2022, accounting for 68.1 percent of the total. Secondly, the use of lip products such as lipstick and lip gloss was also high, reaching 60.6%. Despite the requirement to wear masks during the pandemic, the use of lip products has remained high, reflecting the importance of lip coloring in creating an overall look.

1.4 The rapid growth of online channels helps the development of the industry

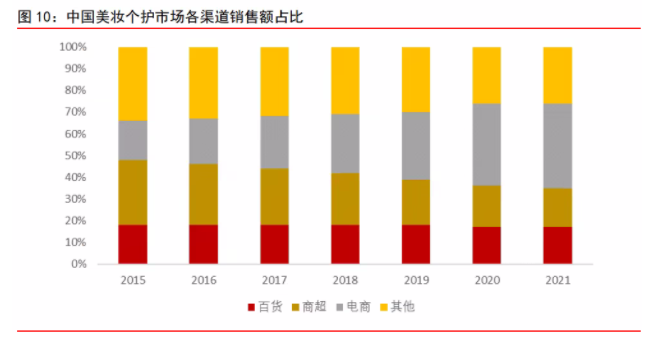

E-commerce channel has become the first big channel of Chinese cosmetics market. According to the China Economic Industry Research Institute, in 2021, e-commerce, supermarket and department store sales will account for 39%, 18% and 17% of China’s beauty care market, respectively. With the rapid popularity of the Internet and the rise of short video platforms such as Douyin Kuaishou, cosmetics brands at home and abroad have opened their online layout. Combined with the accelerated change of residents’ consumption habits caused by the epidemic, e-commerce channels have developed vigorously. In 2021, the proportion of sales of e-commerce channels in China’s beauty care market increased by about 21 percentage points compared with 2015, and it has far exceeded department stores and supermarket channels. The rapid growth of online channels breaks the regional limitations and improves the convenience of cosmetics consumption. Meanwhile, it also provides development opportunities for local cosmetics brands and helps accelerate the development of the overall industry.

2. Foreign brands occupy the mainstream, and domestic brands are replaced faster in popular markets

2.1 Market competition echelons

The competitive echelons of cosmetics brands. According to the Forward-looking Industry Research Institute, global cosmetics companies are mainly divided into three echelons. Among them, the first echelon includes L ‘Oreal, Unilever, Estee Lauder, Procter & Gamble, Shiseido and other international famous brands. In terms of the Chinese market, according to the data of the Forward-looking Industry Research Institute, from the perspective of product price and target groups, China’s cosmetics market can be divided into five segments, namely high-end (luxury) cosmetics, high-end cosmetics, medium and high-end cosmetics, mass cosmetics, and the ultimate cost-effective market. Among them, the high-end field of Chinese cosmetics market is dominated by foreign brands, most of which are international top cosmetics brands, such as LAMER, HR, Dior, SK-Ⅱ and so on. In terms of local cosmetics brands, they mainly target at the middle and high-end, popular and extremely cost-effective markets in China, such as Pelaya and Marumi.

2.2 Foreign brands still dominate

Big European and American brands lead the market share of cosmetics in our country. According to the data of Euromonitor, in 2020, the top brands in the market share of Chinese cosmetics industry are L ‘Oreal, Procter & Gamble, Estee Lauder, Shiseido, Louis Denwei, Unilever, AmorePacific, Shanghai Jahwa, Jialan and so on. Among them, European and American cosmetics brands enjoy high popularity in the Chinese market, and L ‘Oreal and Procter & Gamble keep leading market shares. According to Euromonitor, the market shares of L ‘Oreal and Procter & Gamble in China’s cosmetics market in 2020 were 11.3% and 9.3%, respectively, up 2.6 percentage points and down 4.9 percentage points compared with 2011. It is worth noting that since 2018, L ‘Oreal’s market share in China has accelerated.

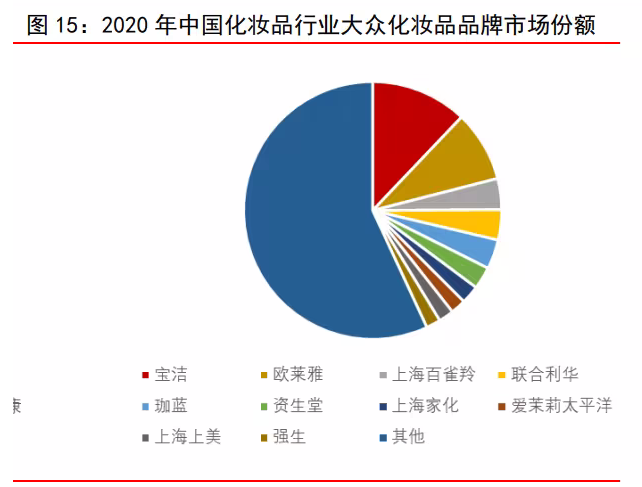

In the high-end field of Chinese cosmetics, L ‘Oreal and Estee Lauder’s market share exceeds 10%. According to Euromonitor, in 2020, the top three international top brands in the high-end market of Chinese cosmetics industry are L ‘Oreal, Estee Lauder and Louis Vuitton, respectively, with corresponding market shares of 18.4%, 14.4% and 8.8%. In terms of domestic brands, in 2020, among the TOP 10 high-end cosmetics brands in China, two are local brands, respectively Adolfo and Bethany, with corresponding market share of 3.0% and 2.3%. Visible, in the high-end cosmetics field, domestic brands still have a large room for improvement. In the field of Chinese mass cosmetics, Procter & Gamble leads the way and domestic brands occupy a place. According to Euromonitor, in China’s mass cosmetics market in 2020, Procter & Gamble’s market share reached 12.1%, ranking the first in the market, followed by L ‘Oreal’s share of 8.9%. And the local brands have a certain competitive strength in Chinese mass cosmetics market. Among the top 10 brands in 2020, local brands account for 40%, including Shanghai Baiquelin, Jia LAN Group, Shanghai Jahwa and Shanghai Shangmei, with corresponding market shares of 3.9%, 3.7%, 2.3% and 1.9% respectively, among which Baiquelin ranks the third.

2.3 high-end market concentration is higher, the mass market competition is more intense

In recent ten years, the concentration of cosmetics industry decreased first and then increased. According to the Forward-looking Industry Research Institute, from 2011 to 2017, the concentration of China’s cosmetics industry continued to decline, with CR3 dropping from 26.8 percent to 21.4 percent, CR5 from 33.7 percent to 27.1 percent, and CR10 from 44.3 percent to 38.6 percent. Since 2017, the industry concentration has gradually recovered. In 2020, the concentration of CR3, CR5 and CR10 in the cosmetics industry rose to 25.6%, 32.2% and 42.9%, respectively.

The concentration of high-end cosmetics market is high and the competition of mass cosmetics market is fierce. According to Euromonitor, in 2020, CR3, CR5 and CR10 of China’s high-end cosmetics market will account for 41.6%, 51.1% and 64.5% respectively, while CR3, CR5 and CR10 of China’s mass cosmetics market will account for 24.9%, 32.4% and 43.1% respectively. It is obvious that the competitive pattern of cosmetics high end market is relatively superior. However, the concentration of mass market brands is relatively dispersed and the competition is fiercer. Only Procter & Gamble and L ‘Oreal have relatively high share.

3. Post-epidemic recovery + rising tide, optimistic about the future development of local cosmetics

3.1 Post-epidemic recovery and large room for per capita consumption growth

During the epidemic, consumer demand for makeup has been greatly affected. Since the end of 2019, the repeated impact of the novel coronavirus pandemic has restricted residents’ travel and affected their demand for makeup to some extent. According to the survey data of iMedia Research, in 2022, nearly 80% of Chinese consumers believe that the epidemic has an impact on the demand for makeup, and more than half of them think that the situation of working at home during the epidemic will reduce the frequency of makeup.

The impact of the epidemic is gradually fading, and the cosmetics industry is about to recover. In the past three years, the repeated impact of the novel coronavirus epidemic has hindered the development of China’s macro economy to some extent, and the demand for cosmetics has declined due to negative factors such as the weakened consumption willingness of residents, travel restrictions, mask restrictions and logistics obstacles. According to the National Bureau of Statistics, the cumulative retail sales of consumer goods in 2022 were 439,773.3 billion yuan, down 0.20% year on year; The retail sales of cosmetics were 393.6 billion yuan, down 4.50% year on year. In 2023, China will implement “Class B and B tube” for the novel coronavirus infection and no longer implement quarantine measures. The impact of the epidemic on the Chinese economy is gradually weakened, consumer confidence has rebounded, and the offline human flow has rebounded significantly, which is expected to boost the demand of the cosmetics industry. According to the latest data from the National Bureau of Statistics, the retail sales of consumer goods increased by 3.50% in the first two months of 2023, among which the retail sales of cosmetics increased by 3.80%.

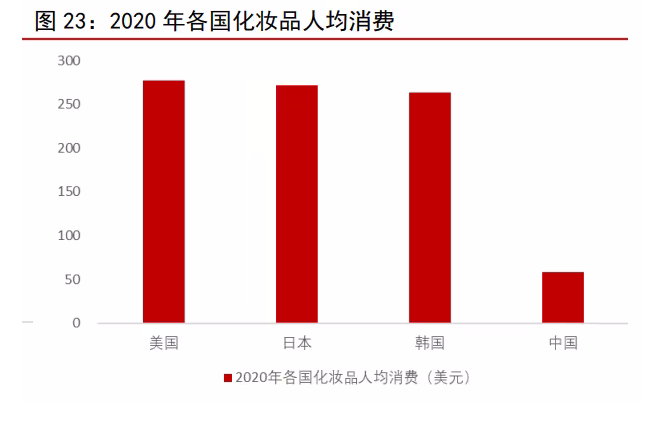

The improvement of per capita consumption level of cosmetics is large. In 2020, per capita consumption of cosmetics in China was $58, compared with $277 in the United States, $272 in Japan and $263 in South Korea, all more than four times the domestic level, according to the research. By categories, the gap between Chinese makeup per capita consumption level and that of developed countries is larger. According to the data of Kanyan World, in 2020, the per capita spending on makeup in the United States and Japan will be $44.1 and $42.4 respectively, while in China, the per capita spending on makeup will only be $6.1. Per capita makeup consumption in the United States and Japan ranks among the highest in the world, 7.23 times and 6.95 times that of China. In terms of skin care, per capita spending in Japan and South Korea is far ahead, reaching $121.6 and $117.4 respectively in 2020, 4.37 times and 4.22 times that of China in the same period. Overall, compared with developed countries, the per capita consumption level of skin care, makeup and other cosmetics is low in our country, which has more than double the room for improvement.

3.2 The rise of China-Chic beauty

The proportion of domestic makeup brands in Chinese makeup market is rapidly increasing. In 2021, Chinese, American, French, Korean and Japanese brands will account for 28.8 percent, 16.2 percent, 30.1 percent, 8.3 percent and 4.3 percent of the makeup market, respectively, according to the China Economic Research Institute. It is worth noting that Chinese cosmetics brands have developed rapidly, with local cosmetics brands increasing their share of the domestic cosmetics market by about 8 percentage points between 2018 and 2020, thanks to national trend marketing, cost-effective advantages, and cultivation of new brands and blockbuster items. In the era of the rise of domestic products, international groups are also competing for the low-end domestic market through parity brands, and Chinese cosmetics market competition is becoming increasingly fierce. However, compared with the skincare industry, domestic brands can regain domestic market share faster in the cosmetics industry, which has strong fashion attributes and low user stickiness.

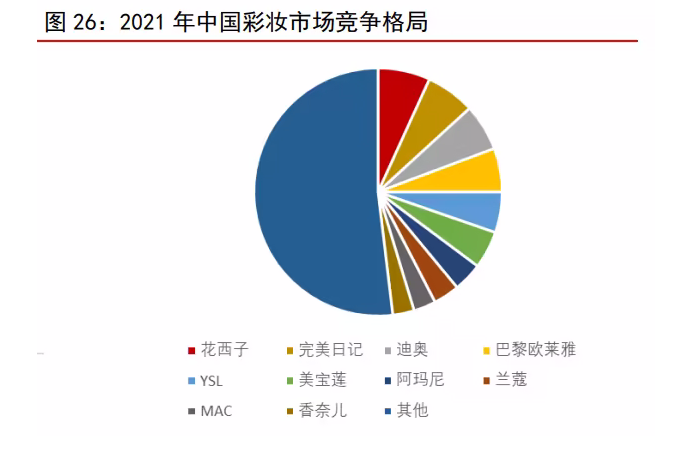

In China’s makeup industry, the market share of head brands has slipped, and domestic brands have successfully counterattacked. Data from China Economic Research Institute shows that in 2021, CR3, CR5 and CR10 of China’s makeup industry will be 19.3%, 30.3% and 48.1%, respectively, down by 9.8 percentage points, 6.4 percentage points and 1.4 percentage points compared with 2016. In recent years, the overall concentration of makeup industry in China has declined, mainly because the market share of leading enterprises such as L ‘Oreal and Maybelline has declined significantly. According to the China Economy Industrial Research Institute, the TOP 1 and TOP 2 in the makeup market in 2021 are Huaxizi and Perfect Journal, with market share of 6.8% and 6.4% respectively, both increased by more than 6 percentage points compared with 2017, and have successfully surpassed Dior, L ‘Oreal, YSL and other international big brands. In the future, with the decline of the boom of domestic products, the makeup industry still needs to return to the essence of products. Brand, product quality, product efficacy, marketing innovation and other directions are the key to the sustainable and healthy development of local brands after their emergence.

3.3 Male beauty economy, expand the capacity of cosmetics market

China’s male skin care market is growing rapidly. With the development of The Times, the concept of beauty and skin care is paid more and more attention by male groups. The popularity of male makeup is also gradually improving, and the demand for male skin care and makeup is growing day by day. According to CBNData’s 2021 Men’s Skincare Market Insight, the average male consumer will buy 1.5 skincare products and 1 makeup product per month. Data from Tmall and imedia Research show that from 2016 to 2021, the market scale of male skincare products in China grew from 4.05 billion yuan to 9.09 billion yuan, with a CAGR of 17.08% during the period. Even under the impact of the epidemic, the scale of Chinese men’s skin care market has continued to grow, which shows its considerable consumption potential. Imedia Research estimates that the scale of Chinese men’s skin care market will exceed 10 billion yuan in 2022, and is expected to increase to 16.53 billion yuan in 2023, with an average annual compound growth rate of 29.22% from 2021 to 2023.

Most men already have a skincare routine, but a smaller percentage wear makeup. According to the 2021 “Male Beauty Economy” research report released by Mob Research Institute, more than 65% of men have bought skin care products for themselves, and more than 70% of men have skin care habits. But men’s acceptance of makeup is still not high, has not developed a beauty habit. According to the survey data of Mob Research Institute, more than 60% of men never wear makeup, and slightly more than 10% of men insist on wearing makeup every day or often. In the field of makeup, mature men prefer to buy perfume products, and post-1995 men have a higher demand for eyebrow pencil, foundation and hairline powder.

3.4 Policy support to promote high-quality industrial development

The evolution of industry planning of cosmetics in our country. According to the Foresight Industry Research Institute, during the 12th Five-Year Plan period, the country concentrated on adjusting the structure of the cosmetics industry and optimizing the enterprise structure; During the 13th Five-Year Plan period, the state promoted the perfection of laws and regulations related to cosmetics, amended the cosmetic hygiene supervision regulations, and intensified the supervision to accelerate the industry reshuffle and promote the standardized development of the industry. During the 14th Five-Year Plan period, the state carried out brand building actions to create and cultivate high-end brands of Chinese cosmetics and promote the sustainable and high-quality development of the industry.

The cosmetics industry is under strict supervision and the era of high quality development is the general trend. In June 2020, The State Council promulgated the Regulations on Supervision and Administration of Cosmetics (the New Regulations), which will come into force at the beginning of 2021. Compared with the old Regulation in 1990, cosmetics have changed in terms of definition, scope, division of responsibilities, registration and filing system, labeling, intensity and breadth of punishment, etc. The supervision system of cosmetics industry is more scientific, standardized and efficient, and more emphasis on product safety and high quality. Since the beginning of the 14th Five-Year Plan, policies such as Measures for the Registration and Filing of Cosmetics, Standards for the Evaluation of Cosmetic Product Efficacy Claims, Measures for the Supervision and Management of Cosmetic Production and Operation, Standards for the quality management of Cosmetic Production, and Measures for the Management of Adverse Reaction Monitoring of Cosmetics have been successively issued, which have standardized and rectified various aspects of the cosmetic industry. Symbolizes that our country is supervising to cosmetics industry increasingly strict. At the end of 2021, China Fragrance & Fragrance Cosmetics Industry Association passed the 14th Five-Year Development Plan for China’s Cosmetics Industry, which requires continuous narrowing of the adaptation gap between industry development and regulatory requirements, and deepening supply-side structural reform based on reform and innovation. The continuous improvement of cosmetics related policies and regulations, the continuous innovation and development of the industry, and the continuous improvement of the local cosmetics enterprises will guide and promote the high-quality development of the industry.

3.5 Return products, functional skin care is popular

Consumption is gradually returning to rationality, and products are returning to quality and efficacy. According to IIMedia research data, in 2022, what Chinese consumers most expect from the development of the cosmetics industry is to prolong the duration of the product effect, and the approval rate is as high as 56.8%. Secondly, Chinese consumers pay more and more attention to the compound effect of cosmetics, accounting for 42.1% of the total. Consumers attach more importance to the effect of cosmetics than the factors such as brand, price and promotion. In general, with the standardized development of the industry, product quality and technology continue to optimize, cosmetics consumption will tend to be rational, product effect, compound effect, price friendly products have more market advantages. After the marketing war, cosmetics enterprises have turned to the science and technology war, increasing research and development investment, improve product efficacy and performance, in order to seize more shares in the new consumer market.

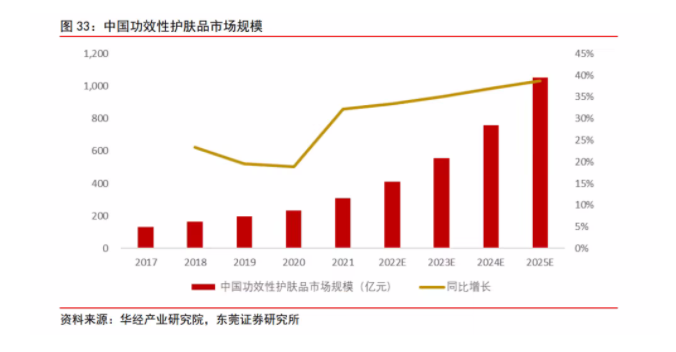

China’s functional skin care market has achieved a leap forward and is expected to maintain rapid development in the next few years. Data from Huachen Industry Research Institute shows that from 2017 to 2021, the market scale of China’s efficacy skin care industry grew from 13.3 billion yuan to 30.8 billion yuan, with a compound growth rate of 23.36%. Despite repeated impacts of COVID-19, the market for efficacy skin care products still maintained rapid growth. In the future, as the impact of the epidemic gradually fades, consumer confidence gradually returns to normal, functional skin care demand will usher in a recovery, according to the China Economic Research Institute forecast, China’s functional skin care market scale will reach 105.4 billion yuan in 2025, breaking through billions of scale, CAGR is expected to be as high as 36.01% during 2021-2025.

4. Cosmetics industry chain and related key companies

4.1 Cosmetics Industry Chain

Our cosmetics industry chain includes upstream raw materials, midstream brands, and downstream sales channels. According to the prospectus of China Economic Research Institute and Kosi Stock, the upstream of cosmetics industry is mainly cosmetics raw material suppliers and packaging material suppliers. Among them, cosmetics raw materials include matrix, surfactant, performance and technical components, active ingredients four categories. The upstream material suppliers of cosmetics have a relatively weak right to speak, mainly due to their lack of technology, inspection and testing, research and development innovation and other aspects. Cosmetics industry for the middle of the brand, in the overall industrial chain in a strong position. Cosmetics brands can be divided into domestic brands and imported brands. Those who are dominant in production process, product packaging, marketing and publicity, etc., have stronger brand effect and higher product premium ability. The downstream of the cosmetics industry is channel providers, including online channels such as Tmall, Jingdong and Douyin, as well as offline channels such as supermarkets, stores and agents. With the rapid development of the Internet, online channels have become the first major channel for cosmetic products.

4.2 Listed companies related to the industrial chain

Cosmetics industry chain listed companies mainly concentrated in the middle and upper reaches. (1) Upstream of the industrial chain: according to the subdivision of materials, upstream raw material suppliers supply hyaluronic acid, collagen, flavor, etc. Among them, the manufacturers of hyaluronic acid are Huaxi Biological, Lushang Development’s Furuida, etc., the supply of collagen are Chuanger Biological, Jinbo Biological, etc., the supply of daily chemical flavor and fragrance enterprises, including Kosi Shares, Huanye spices, Huabao Shares, etc. (2) Middle stream of the industrial chain: Chinese local cosmetics brands have gradually grown and many companies have been listed successfully. For example, in the A-share market, Pelaya, Shanghai Jahwa, Marumi, Shuiyang, Betaini, Huaxi Biology, etc., in the Hong Kong stock market, Juzi Biology, Shangmei Shares, etc.

Post time: Apr-04-2023